Want to own a small and simple house? But confused and dizzy calculating the initial installments? You are still confused about calculating the mortgage that will be taken or even the mortgage that is already running. No need to be confused anymore, now there is a Mortgage Calculator that can help all your home installment problems.

Mortgage Calculator is intended to help owners or prospective housing owners determine how much the ability of people in general to make home ownership loans (KPR). Mortgage calculator can also be used to compare costs, loan interest rates, payment schedules, or help calculate the loan term, for example by adding a down payment amount. Mortgage calculator can also be used to calculate motor vehicle ownership loans (KPM), for KPM generally use the type of credit "in advance".

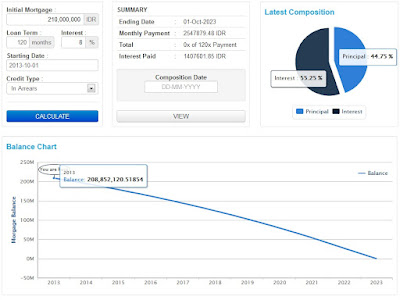

Mortgage Calculator is useful to help you calculate the potential cost of mortgage installments. The potential cost is calculated per month based on the Initial Mortgage (total real estate price minus Down Payment value), Loan Term (number of months to make installments), Interest (interest charged), Starting Date (date of starting installments), Credit Type (In Arrears): The first installment is made in the following month after making a down payment, In Advance: The first installment is made at once with the down payment, the next month is the second installment and so on).

If you have filled in all the fields on the side, then click "CALCULATE" to get the result of your real estate installment calculation. To see the Latest Composition in the next few years, you can use "Composition Date". Specify the date in the composition date, then click "View".

After you click "View", in the Latest Composition column there will be changes in the percentage of principal and interest charged. And in the Summary column, for Interest Paid also changes (the closer to the end of the installment, the smaller the interest fee charged, this is inversely proportional to the principal loan charged).

Balance Chart

Balance Chart serves to see only the remaining principal loan from year to year which is decreasing, until the end of the installment period.

With this calculator, it is very easy and helpful for you to calculate home installments. Until you no longer need to feel burdened to pay home installments (red: KPR). As simple as that is not it, with this calculator you can find out how many installments you have to pay without having to mess around to calculate it manually.

Simply by entering the calculation, everything will be done by itself. It's that easy isn't it. Remembering during the Covid19 pandemic where everything stopped suddenly including the problem of paying the ongoing home installments.

When some of you are laid off or arguably dismissed from work and even work at home. Has changed everything. Including how you pay any installments, including home installments.

This causes what has been planned to fall apart and even plans to own a home. However, with the end of the Covid19 pandemic where everything is about to return. You can reorganize the plans that have been made including plans to own a home.

If you are ready to start a home mortgage, it is always good to calculate using a Mortgage Calculator to make it easier and even ease the installment payments until the house is yours.

Ok easy isn't it, so no need to worry about home installments, there is a Mortgage Calculator that can help you in calculating your home installment installments.

%20(26).jpeg)

.png)

%20(3).jpeg)

%20(23).jpeg)

%20(1).jpeg)

![[Tantangan 4] Pejuang Salome [Tantangan 4] Pejuang Salome](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgCPCit3VKdtIqXXs-FcD5U8PrSTtNp4LIDgihKKbrAaYXtqOXHuBalHdHeqe1cTxBQP_7j_4skRvMWSxrT9YTDgHu8bNq76F2RKLGWEw3Q-elrlLRniQcb1TfL_FXcu4MvuQQEzMG7EZc/w360-h120-p-k-no-nu/cilok-isi-salome-foto-resep-utama+%25281%2529.jpg)

Wah keren juga bisa bikin artikel bahasa inggris sepanjang ini... Hebat

ReplyDeleteLagi mencoba bang tau benar atau masih banyak yang salah bahasa inggrisnya.

Delete